Why Always Choose a Bank Settlement Loan for Any Type of Loan Settlement

In today’s fast-paced financial world, loans have become a necessity be it personal loans, credit cards, business loans, or home loans. However, due to unforeseen circumstances like job loss, medical emergencies, business slowdowns, or economic instability, many borrowers find it difficult to repay their EMIs on time. This is where loan settlement comes into the picture. Among the different ways to settle outstanding dues, a Bank Settlement Loan stands out as the most reliable, transparent, and borrower-friendly option. Let’s explore why choosing a bank settlement loan is always the smarter decision for any type of loan settlement.In today’s fast-paced financial world, loans have become a necessity—be it personal loans, credit cards, business loans, or home loans. However, due to unforeseen circumstances like job loss, medical emergencies, business slowdowns, or economic instability, many borrowers find it difficult to repay their EMIs on time. This is where loan settlement comes into the picture.

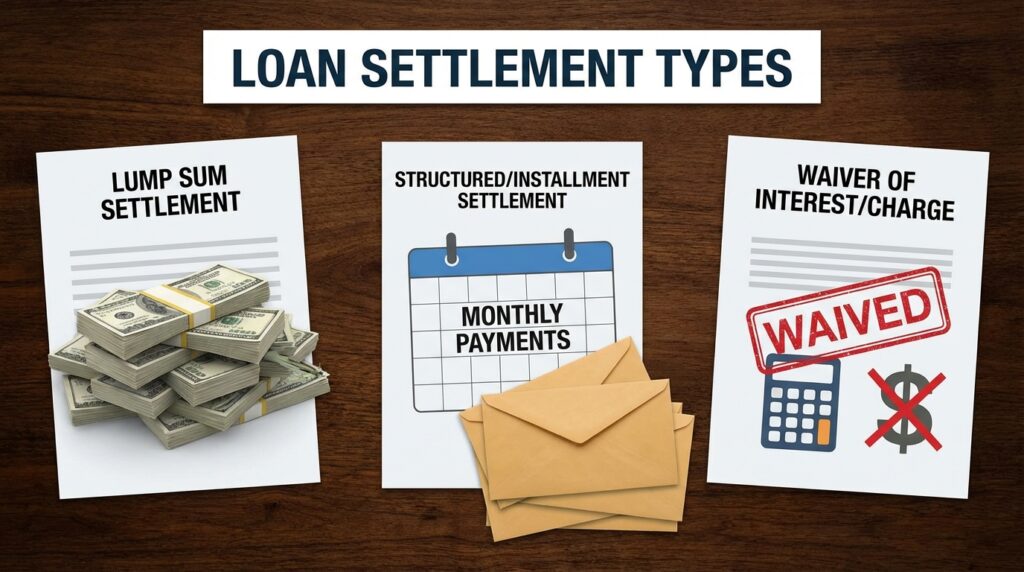

Types of Loan Settlement

Loan settlements primarily involve negotiating with lenders to pay a reduced, final amount on debts, typically categorized by the debt type (personal, credit card, business, or vehicle) or the settlement structure (lump-sum or installment). Common types include one-time settlements, term settlements, and, in rare cases, secured loan settlements. Lum-sum Settlement A lump sum settlement is a single, one-time payment that resolves a financial obligation, like an insurance claim, lawsuit, or retirement payout, instead of smaller, periodic installments. It offers immediate liquidity and control for major expenses or investments but requires careful planning, often involving consulting financial and legal experts to manage taxes, inflation, and future needs effectively, as it typically closes the claim permanently. . Structured/Installment Settlement A structured settlement (or installment settlement) is an agreement to pay off negotiated debt through regular, smaller payments rather than a single lump sum, allowing debtors to resolve liabilities over time. It acts as a debt relief method, benefiting debtors with manageable payments and creditors by securing partial, consistent repayment. Waiver of Interest/Charge A loan waiver of interest or charges is a, often government-backed, relief measure where lenders, such as banks or financial institutions, cancel a portion or the entirety of outstanding interest, fees, and penalties due to a borrower’s inability to repay, usually due to financial hardship. Unlike a write-off, a waiver extinguishes the debt liability for the waived amount, providing immediate financial relief.