Why Always Choose a Bank Settlement Loan for Any Type of Loan Settlement

In today’s fast-paced financial world, loans have become a necessity be it personal loans, credit cards, business loans, or home loans. However, due to unforeseen circumstances like job loss, medical emergencies, business slowdowns, or economic instability, many borrowers find it difficult to repay their EMIs on time. This is where loan settlement comes into the picture. Among the different ways to settle outstanding dues, a Bank Settlement Loan stands out as the most reliable, transparent, and borrower-friendly option. Let’s explore why choosing a bank settlement loan is always the smarter decision for any type of loan settlement.In today’s fast-paced financial world, loans have become a necessity—be it personal loans, credit cards, business loans, or home loans. However, due to unforeseen circumstances like job loss, medical emergencies, business slowdowns, or economic instability, many borrowers find it difficult to repay their EMIs on time. This is where loan settlement comes into the picture.

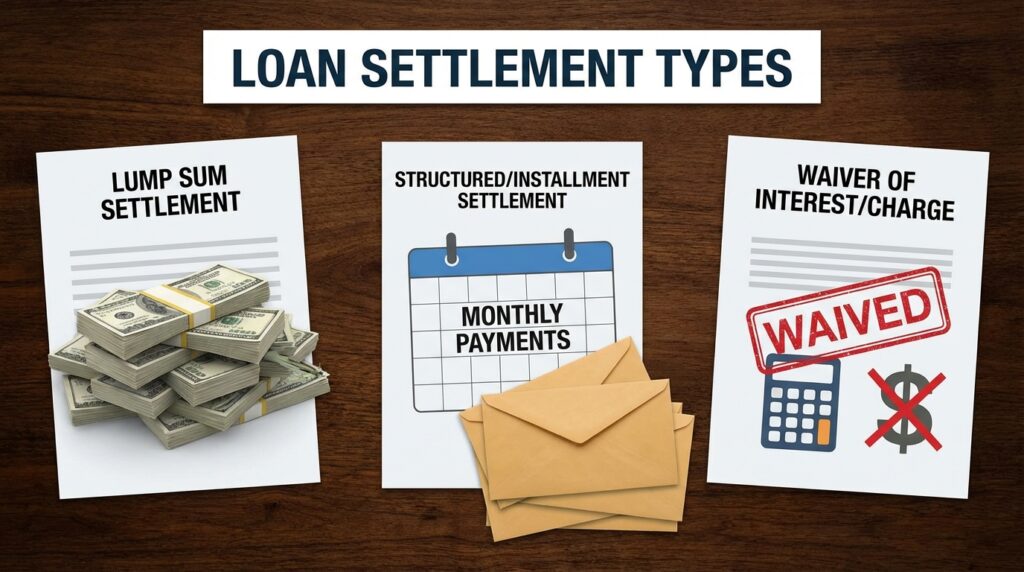

Types of Loan Settlement

Loan settlements primarily involve negotiating with lenders to pay a reduced, final amount on debts, typically categorized by the debt type (personal, credit card, business, or vehicle) or the settlement structure (lump-sum or installment). Common types include one-time settlements, term settlements, and, in rare cases, secured loan settlements. Lum-sum Settlement A lump sum settlement is a single, one-time payment that resolves a financial obligation, like an insurance claim, lawsuit, or retirement payout, instead of smaller, periodic installments. It offers immediate liquidity and control for major expenses or investments but requires careful planning, often involving consulting financial and legal experts to manage taxes, inflation, and future needs effectively, as it typically closes the claim permanently. . Structured/Installment Settlement A structured settlement (or installment settlement) is an agreement to pay off negotiated debt through regular, smaller payments rather than a single lump sum, allowing debtors to resolve liabilities over time. It acts as a debt relief method, benefiting debtors with manageable payments and creditors by securing partial, consistent repayment. Waiver of Interest/Charge A loan waiver of interest or charges is a, often government-backed, relief measure where lenders, such as banks or financial institutions, cancel a portion or the entirety of outstanding interest, fees, and penalties due to a borrower’s inability to repay, usually due to financial hardship. Unlike a write-off, a waiver extinguishes the debt liability for the waived amount, providing immediate financial relief.

What is Bank Loan Settlement?

A bank loan settlement is a negotiated agreement between a borrower and a lender to close a debt for less than the full outstanding amount, typically when the borrower faces severe financial hardship. The account is marked “settled” rather than “closed,” significantly hurting credit scores and remaining on reports for up to 7 years.

Top Reasons People Choose Debt Settlement Over Other Solutions

Debt settlement has become a preferred choice for many borrowers struggling with high EMIs, overdue loans, or financial hardships. One major reason is that it allows borrowers to significantly reduce the outstanding amount instead of paying the full loan balance. For those who cannot afford regular payments, settlement offers a realistic path to closing the account without additional loans or long-term commitments. Another reason is the relief from recovery pressure. Once a settlement case begins, negotiation teams communicate with lenders on your behalf, protecting you from harassment and repeated calls. This helps borrowers regain emotional peace and focus on improving their finances. Debt settlement is also faster compared to lengthy restructuring programs or legal proceedings. With proper documentation and a strong negotiation strategy, borrowers can close their accounts within months instead of years. Additionally, settlement helps avoid further penalties, late fees, and increasing interest. Many people also prefer settlement because it provides a clear ending. Instead of carrying loan stress for years, they can settle the amount and start rebuilding their financial life sooner. For individuals facing genuine hardship, debt settlement offers the most practical, affordable, and stress-free solution.

Why Legal Support Is Important During Loan Settlement

Legal support plays a crucial role in ensuring a smooth and safe debt settlement process. When borrowers face overdue payments or loan defaults, they often encounter aggressive recovery agents, continuous calls, or threatening communication. Many individuals are unaware of their legal rights and end up making decisions under pressure. Having a legal expert by your side ensures that you are protected from harassment and that the entire settlement process follows proper guidelines. A professional legal team communicates directly with lenders, presents your financial difficulties legally, and negotiates fair settlement terms. They review your case documents, analyze your repayment capacity, and build a strong argument that increases the chances of a favorable settlement. Legal advisors also ensure that all agreements and settlement letters are properly documented, preventing any future disputes. With legal guidance, you remain safe from wrongful practices and avoid signing unclear or misleading documents. This gives you more confidence and peace of mind throughout the settlement journey. Most importantly, legal experts ensure transparency, protect your rights, and help you achieve a reasonable and stress-free loan closure.

How Debt Settlement Helps You Regain Financial Control

Debt settlement has become one of the most effective ways for individuals to regain stability when dealing with overwhelming credit card or loan debt. Many people struggle with rising EMIs, late payment fees, and constant recovery calls, which not only affect their financial health but also cause emotional stress. Debt settlement offers a structured solution by negotiating with lenders to reduce the outstanding amount, allowing you to close your loan at a mutually agreed and affordable payment. Unlike other options such as balance transfers or additional loans, settlement focuses on reducing the burden rather than adding more liabilities. A skilled negotiation team works on your behalf, presents your financial hardship to the lender, and secures the best settlement terms possible. This process not only lowers your repayment amount but also stops harassment from recovery teams, giving you time and mental peace to rebuild your finances. With proper guidance, documentation, and expert negotiators, debt settlement becomes a powerful tool to regain control of your financial future. It allows you to close overdue accounts, improve your budgeting habits, and eventually rebuild your credit score with confidence.